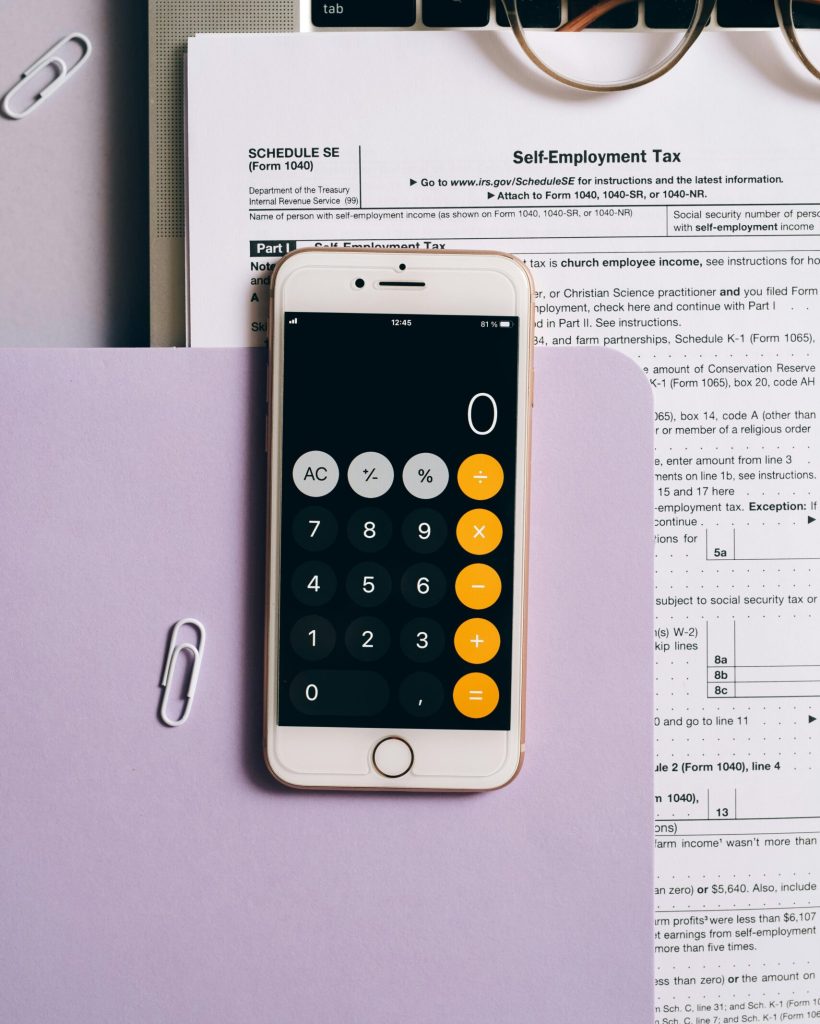

What is VAT ?

The Value Added Tax (VAT) is a consumption tax levied on the sale of goods and services at every step of production or distribution. It is an essential component of the tax system, ensuring that companies positively impact the economy through their operations. VAT is levied at every point in the supply chain where value is added.

The fundamental objective of VAT is to generate money for the government transparently and equitably. VAT is a major source of revenue for the UAE government, funding public services and infrastructure projects.

VAT was established in the UAE on January 1, 2018, with a standard rate of 5%. This represented a substantial change in the country’s taxation environment, bringing the UAE in line with worldwide standards and broadening its income streams.

It ensures that businesses along the supply chain contribute to the national economy. Furthermore, VAT additionally fosters accountability and transparency in business transactions, resulting in a fair tax system in which businesses contribute equally.

VAT compliance is essential for businesses to avoid fines and operate efficiently within the legal structure.

What Service We Provide

We provide a complete array of VAT services, which include:

VAT Registration

It may be difficult for any company to figure out the VAT registration procedure. Transacle simplifies this difficult task by ensuring that the relevant documentation is precisely written and delivered appropriately. Our team of professionals will walk you through every step of the process, from knowing your obligations to obtaining your VAT certificate. We save you time and assure complete compliance by overseeing the whole procedure, enabling you to solely concentrate on building your business with ease.

Return Filing

Correct on-time VAT return filing is critical for being compliant and avoiding fines. Transacle's professionals manage your VAT tax submissions with accuracy, attention to detail, and deadlines. By using our expertise, we eliminate errors and guarantee that your returns are in perfect order, reducing the risk of non-compliance and allowing you to focus on your primary business operations.

Refund

Obtaining VAT refunds can be a complicated and time-consuming procedure. Transacle helps you navigate this procedure smoothly, ensuring you obtain the refunds without excessive waiting. Our team of professionals evaluates your transactions, creates precise claims, and follows up with authorities to speed up the refund process. This improves cash flow and allows you to invest gains back into your company.

Consultancy

Our consulting services provide strategic, targeted guidance to help you handle the complexities of VAT rules. Transacle's professionals offer insights and solutions tailored to your individual company's needs, ensuring ideal tax circumstances and compliance. Whether you want guidance on complex VAT issues or strategic planning to reduce tax obligations, our consulting service allows you to make informed decisions that improve your company's financial health.

Pre Audit

Transacle's extensive pre-audit services can help your company prepare for future audits. We thoroughly analyse your VAT operations and documentation to find possibilities for improvement and ensure everything is in order. By proactively resolving any concerns, we help you prevent problems during an official audit, providing you with assurance that your VAT operations are compliant and transparent.

Health Checkup

Regular VAT evaluations are vital for ensuring compliance and avoiding potential issues. Transacle's thorough assessments detect potential risks and assure continuing compliance with VAT requirements. Our thorough health checkup service offers you practical information and recommendations, allowing you to maintain strong VAT systems and avoid hefty fines. This proactive strategy keeps your firm compliant and prepared for growth.

Reconsideration- penalty waiver

VAT fines can be frustrating and costly. Transacle's team excels at assisting with reconsideration petitions and penalty waiver applications. We extensively evaluate your situation, formulate powerful dispute resolution strategies, and file detailed applications with the authorities. Our expertise increases your chances of decreasing or eliminating fines, giving you substantial relief and enabling you to refocus on your company endeavours.

VAT registration exception

Certain companies may qualify for VAT registration exemptions, but managing the eligibility and application procedures can be difficult. Transacle assesses your company's situation to see whether you qualify for an exemption. We handle the full application procedure on your behalf, making sure all standards are completed and increasing the chance of approval. This solution reduces your administrative strain while also assisting you in maintaining compliance.

Deregistration

Business circumstances might change, requiring deregistration from VAT. Whether you're downsizing or liquidating a firm, Transacle handles the deregistration procedure smoothly. Our expertise guarantees that all legal requirements are completed, relevant documentation is produced, and possible liabilities are addressed. This hassle-free solution reduces risks and avoids needless fines, allowing you to change direction quickly and helping you focus on your next steps.

How can Transacle help ?

-

Transacle is dedicated to reducing the complexity of VAT legislation for your business, offering compliance expertise.

-

Our customised VAT solutions are intended to improve your tax position while delivering clarity and peace of mind.

-

Allow our team of professionals to help you through every step of the VAT process with professionalism and simplicity.

-

Choose Transacle, where dealing with VAT becomes simple and your firm flourishes in the evolving UAE economy.

“VAT is not just a tax; it’s a reflection of a nation’s economic structure and its approach to fairness in public funding”

FAQ

Frequently Asked Questions (FAQs) about VAT in the UAE

VAT (Value Added Tax) is a consumption tax imposed on the sale of goods and services in the UAE. VAT was implemented on January 1, 2018, at a standard rate of 5% and is levied at every step of manufacturing as well as distribution. Businesses collect VAT on sales and can reclaim VAT on purchases, ensuring that tax is only levied on the value contributed at every phase.

To register for VAT, fill out an online application through the Federal Tax Authority's (FTA) portal. You must provide information such as your trade licence, financial documents, and company operations. Transacle streamlines the process by managing the whole application and ensuring that all paperwork is properly produced and filed, saving you time and ensuring proper compliance.

Yes, companies can seek VAT refunds on qualified business-related costs, including VAT paid on products and services acquired for the firm. Transacle helps you in drafting and filing proper refund claims, ensuring that you receive your due returns on time, and enhancing cash flow.

Transacle provides an entire suite of VAT services that are suited to your company's needs, including registration, deregistration, return filing, refunds, advice, pre-audit preparation, health examinations, and penalty exemptions. Our professionals ensure that your company follows all VAT requirements, boosting your tax status and reducing risks.

Businesses with an annual taxable turnover of more than AED 375,000 are obliged to register for VAT. Those with a turnover of AED 187,500 to AED 375,000 can register voluntarily. Understanding your eligibility and registration criteria is critical, and the professionals at Transacle can help you navigate the process to guarantee compliance and prevent penalties.

VAT returns are typically filed quarterly; however, the FTA may assign different timelines depending on your company's type. Each return requires information on sales, purchases output VAT collected, and input VAT claimed. Transacle assures that your VAT returns are filed properly and on time, allowing you to avoid fines and remain compliant.

If you get a penalty from the FTA, please reach out to Transacle immediately. Our team of professionals will evaluate the penalty, draft a reconsideration request, and handle the filing with the FTA. We strive to decrease or eliminate the penalty, giving you financial ease while ensuring compliance.